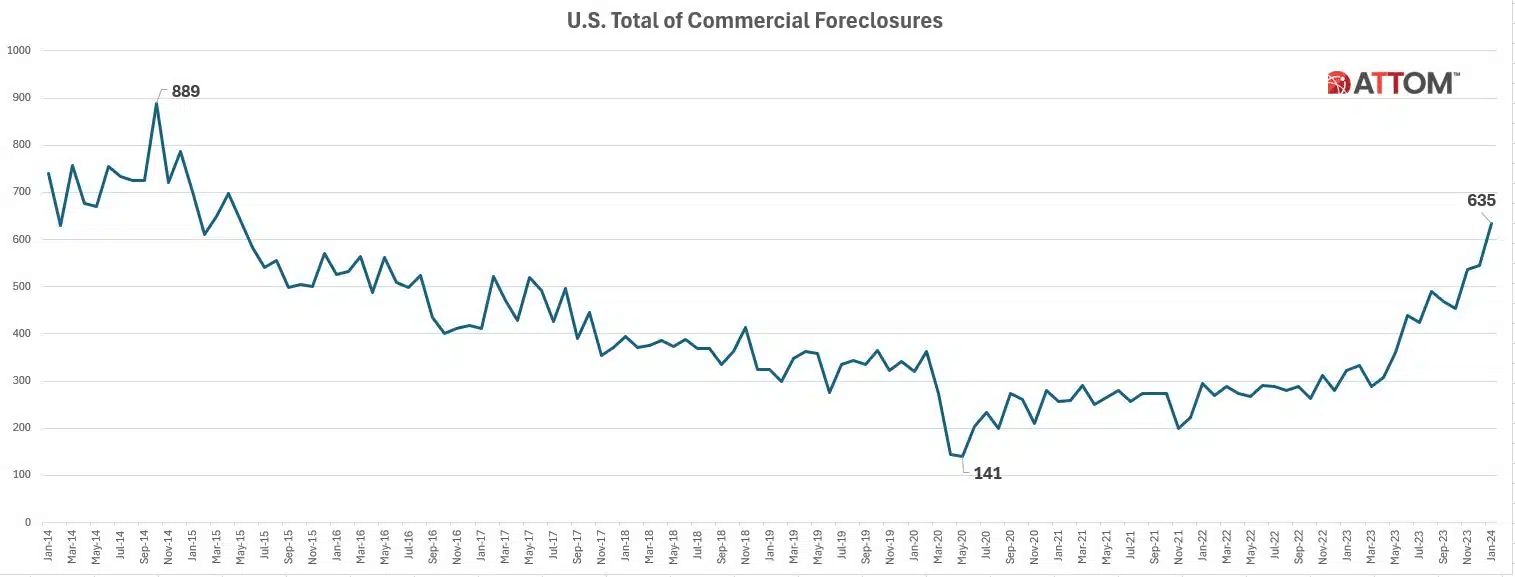

ATTOM Information Remedies recently unveiled a report on industrial genuine estate highlighting a major enhance in foreclosures from a lower of 141 in Might 2020 to 635 in January 2024. This is a 97% YoY improve and displays higher rates’ impression on the current market.

Resource: ATTOM Data Options (February 2024)

California, as a bellwether condition, began the ten years with 209 foreclosures in January 2014. While it professional a decrease in the next months, the foreclosures numbers observed fluctuations reflecting the states dynamic economic weather. By January 2024, California had the highest selection of industrial foreclosures for the thirty day period, at 181. This was a 72 percent raise from previous thirty day period and a 174 % enhance from past 12 months.

Dylan Sloan of Fortune (membership demanded) reviews on comments from sector veteran Fred Cordova, who not long ago commented that about 30% of office environment properties are basically worthless and will want to be torn down or transformed.

That mentioned, Steve Gelsi of MarketWatch experiences that Citi Bank analysts think the strain about industrial serious estate is overblown. Gelsi notes that key banking institutions have previously established apart $39 billion to deal with impending business losses. The analyst notes that though there will be losses, it will be extra akin to a cyclical downturn than a crash predicted by some specialists.

Likewise, Jessica Kuruthukulangara of Trying to find Alpha notes that Jamie Dimon, CEO of JPMorgan Chase, stated recently that industrial serious estate losses will be contained if the U.S. continues to keep away from a economic downturn. As for mounting defaults, Dimon claimed, “part of that’s just a normalization course of action.” But “if premiums go up and we have a recession, there will be true estate problems, and some financial institutions will have a a great deal greater true estate challenge than other people.

Multifamily update

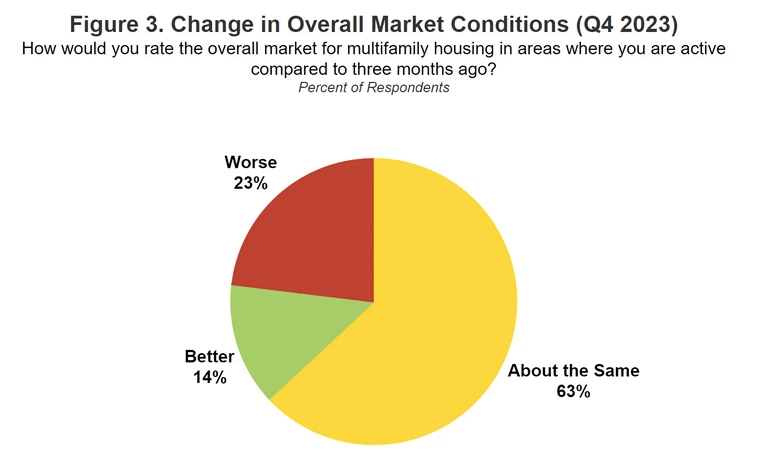

Eric Lynch of the National Association of Dwelling Builders (NAHB) reviews that multifamily builder self confidence is lowering. In commenting on NAHBs Multifamily Industry Study, Lynch notes that: Financing new multifamily tasks proceeds to be complicated because of to restricted lending requirements and the higher charge of advancement financial loans. Provided that, together with the historically significant amount of supply for multifamily models under development, NAHB forecasts a major pullback in multifamily starts off for 2024.

Resource: NAHB (February 2024)

Whilst overall multifamily supply will go on to be superior, there is a gap in what is referred to as missing center multifamily, according to LBM Journal.

For the fourth quarter of 2023, there ended up just 4,000 2- to 4-unit housing device building starts. This is flat from a yr prior. As a share of all multifamily creation, 2- to 4-unit enhancement was just previously mentioned 4% of the overall for the fourth quarter. In distinction, from 2000 to 2010, this sort of residence development made up a tiny a lot less than 11% of complete multifamily development. Construction of the missing center has evidently lagged through the write-up-Wonderful Recession period of time and will continue to do so without zoning reform concentrated on mild-contact density.

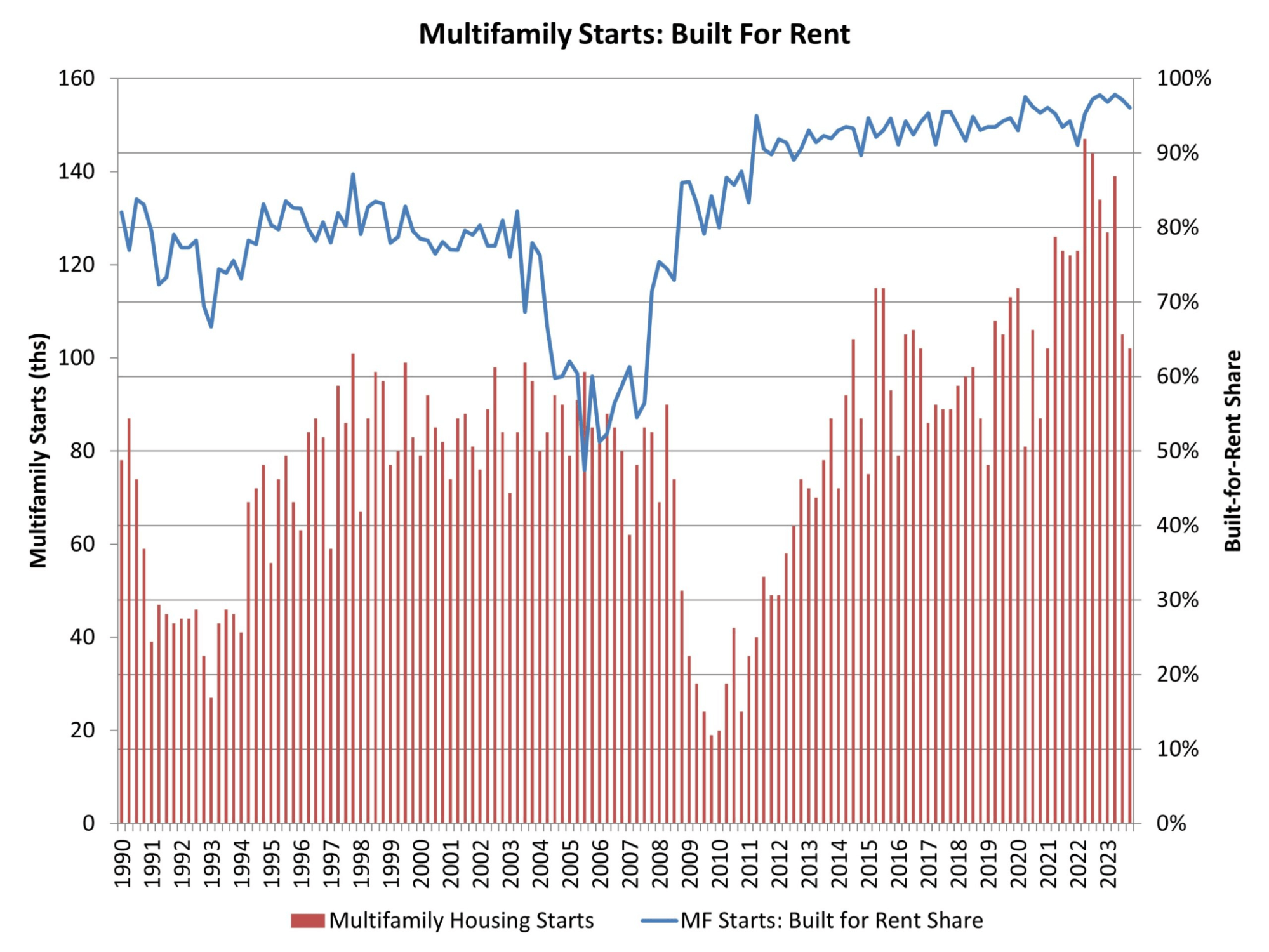

Further more, Robert Dietz of NAHB reviews on designed-to-rent multifamily, whose provide took a little dip in Q4 2023. In Q4 2023, 102,000 multifamily residences begun building, with 98,000 remaining crafted for lease. Rental units created up 96% of multifamily building starts due to the scaled-down condo market place share however getting held again by higher-curiosity fees.

Resource: NAHB (February 2024)

Housing activity up

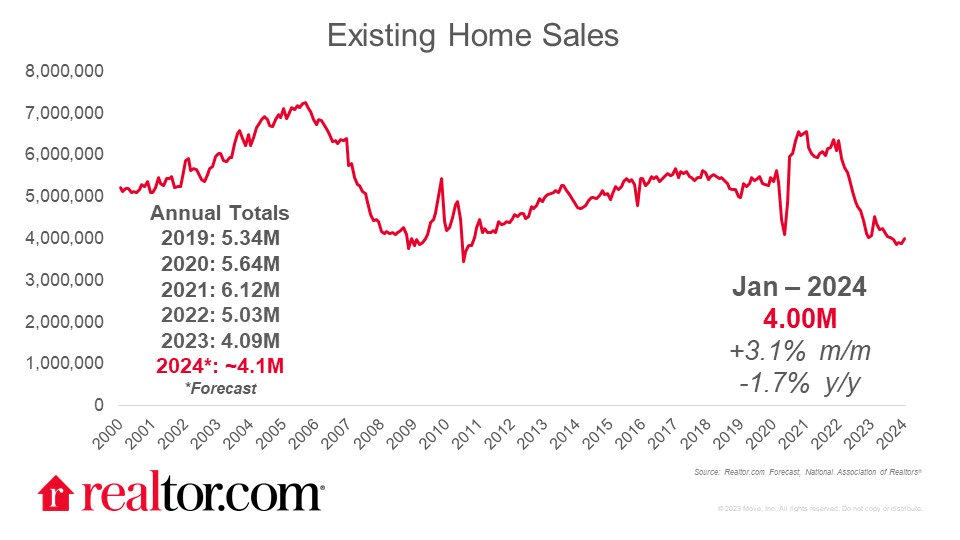

Housing exercise is increasing as we enter a spring marketplace in accordance to Fannie Mae. Existing house income rose 3.1% in January to a seasonally modified annualized price of 4 million. This was the most substantial a person-month raise in 11 months and the most robust revenue rate seen since very last August.

The attain in present house gross sales was in line with our anticipations given the decline in home finance loan fees in November and December (when most of these profits would have gone under deal) and a pickup in house loan purposes. Whilst we continue on to anticipate a gradual restoration in current home sales more than the class of 2024, we note some draw back chance to this forecast as mortgage fees have ticked again up to 6.9 %, as of the most up-to-date Freddie Mac survey, producing home finance loan apps to pull again.

Danielle Hale of Real estate agent.com studies on the increase in income action, highlighting that pending house sales saw a substantial improve in December, expanding above the prior calendar year for the 1st time due to the fact May perhaps 2021. Even so, pending and current residence sales keep on being traditionally lower owing to substantial prices from substantial price ranges and house loan fees. 2023 observed the most affordable complete home gross sales tally in virtually 30 many years.

Supply: Realtor.com (February 2024)

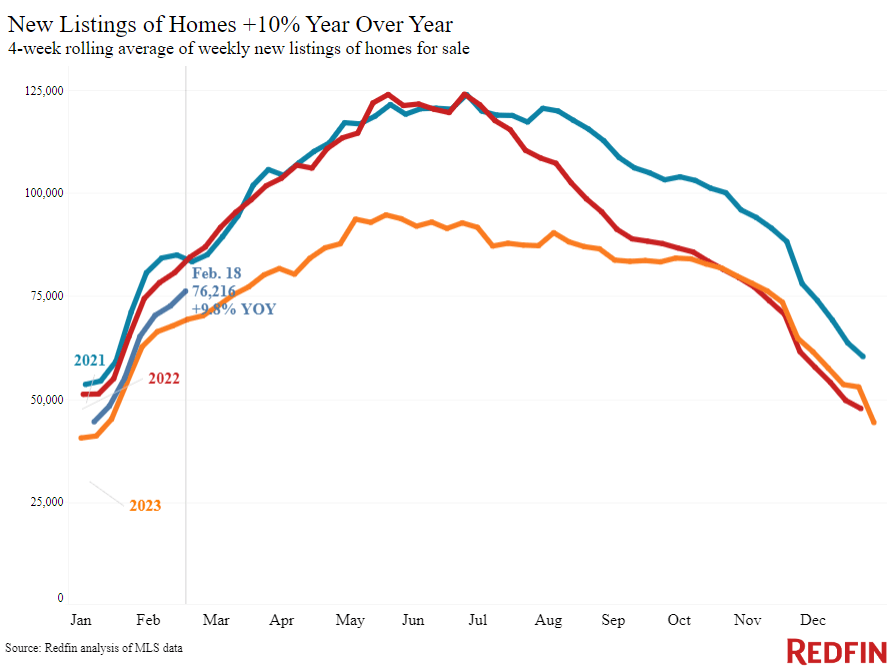

Dana Anderson of Redfin studies on equivalent information, noting that new home listings improved by 10% YoY in the 4 months ending Feb 18th, with sale charges up by 6% YoY. This is the most significant bounce in nine months.

Source: Redfin (February 2024)

Nonetheless, according to Anderson, customers remain hesitant, with a 10% drop in home finance loan invest in apps and a 7% decrease in pending dwelling sales YoY. Everyday common property finance loan premiums have crossed 7%, the initial time considering that mid-December.

Lastly, Orphe Divounguy of Zillow reports on the uptick in housing exercise, commenting that easing home loan charges at the finish of the 12 months brought purchasers and some sellers again into the industry. The flow of present homes onto the for-sale sector has continued to strengthen yr-more than-12 months. Zillow facts exhibits new listings are now up 6%, whilst the variety of homes for sale has improved by 3% as opposed to a year in the past. The housing sector was supply constrained in 2023, and the raise in offer bodes well for prospective house prospective buyers and housing revenue this spring.

DaleDaemicke.com Your Trusted Resource for Real Estate Insights

DaleDaemicke.com Your Trusted Resource for Real Estate Insights