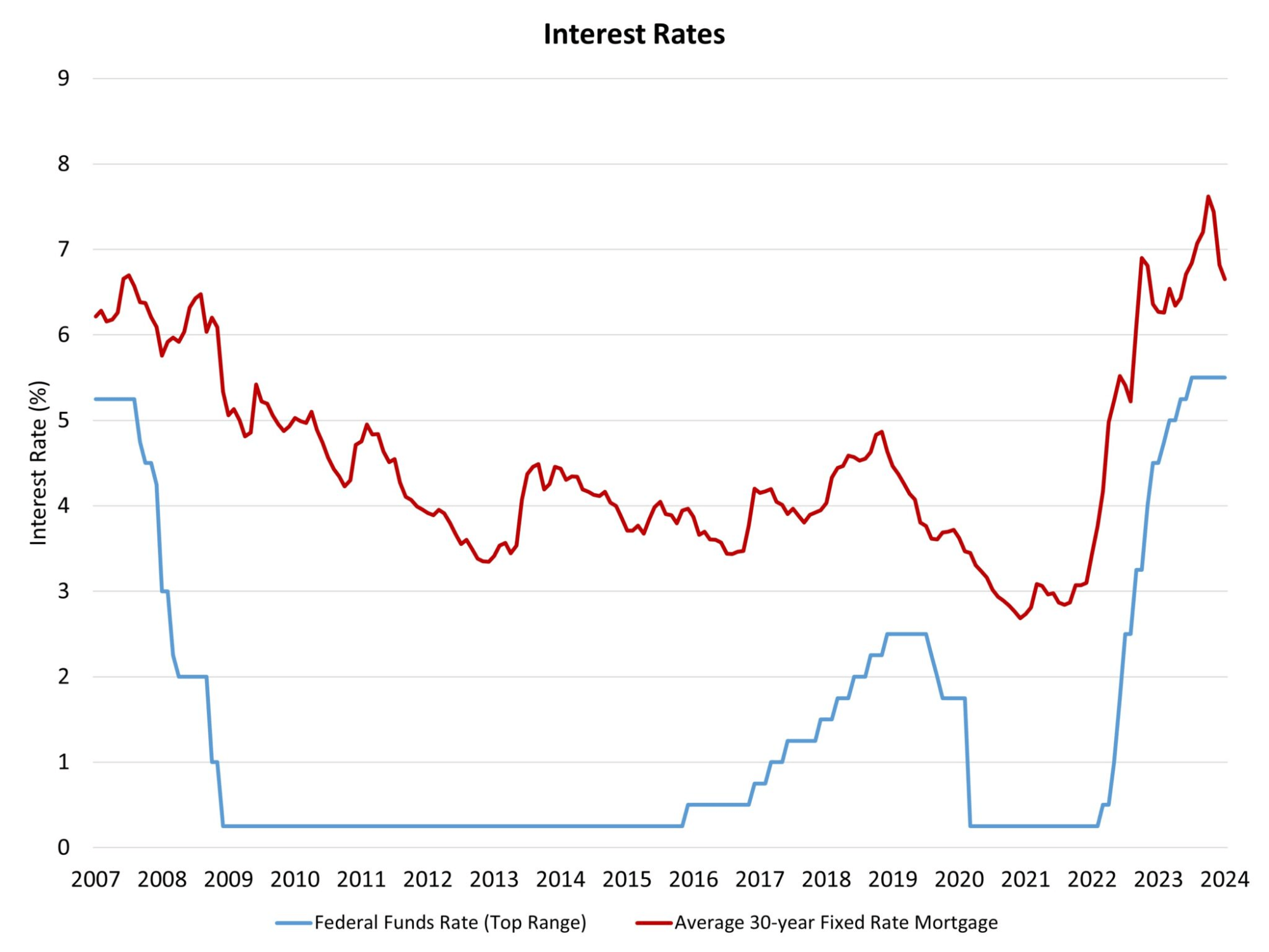

Robert Dietz of the National Association of Home Builders (NAHB) experiences that whilst the Federal Reserve held the federal cash fee constant at 5.5%, markets anticipate a charge cut. That reported, Dietz notes that NAHB’s forecast does not include rate cuts until June because of to solid economic conditions.

Source: NAHB (February 2024)

On the lookout forward, the Feds prior December economic projections propose 3 level cuts in 2024. When the federal resources charge will move reduced later on this calendar year, the Fed will continue on cutting down its harmony sheet, thereby maintaining an elevated spread amongst the 10-yr Treasury charge and charges for 30-calendar year fastened rate mortgagesMortgage charges will proceed to sign up in the significant 6% vary, but under the 8% level housing markets skilled past October. House loan premiums ought to shift lower as 2024 progresses.

Scott Pelley, Aliza Chasan, Henry Schuster, and Sarah Turcotte of CBS News report on an job interview with Fed Chairman Jerome Powell, where by he notes that they wont essentially wait around to hit the 2% inflation goal prior to chopping rates. The following Fed meeting is in March, but Powell stated it was not likely they would slash charges at that conference. The subsequent assembly is Might 1st.

Craig Torres, Chris Anstey, and Catarina Saraiva of Bloomberg report on the probability of amount cuts, highlighting that 4 Fed officials said previous week that they do not see an urgent require to lower desire rates. A cut is not likely right up until at least May perhaps. Fed Chair Jerome Powell emphasized that charge cuts won’t start till inflation is headed in the direction of the Fed’s 2% concentrate on, and building a minimize at the March 19-20 meeting is not likely.

Aly J. Yale of the Wall Avenue Journal experiences on the fee reduce anticipations, noting that next an aggressive amount hike cycle, this yr is poised to be one more turning stage in the house loan entire world. With inflation seemingly underneath manage, the Fed has signaled it could begin slicing interest fees soon, probable around midyear.

House rates

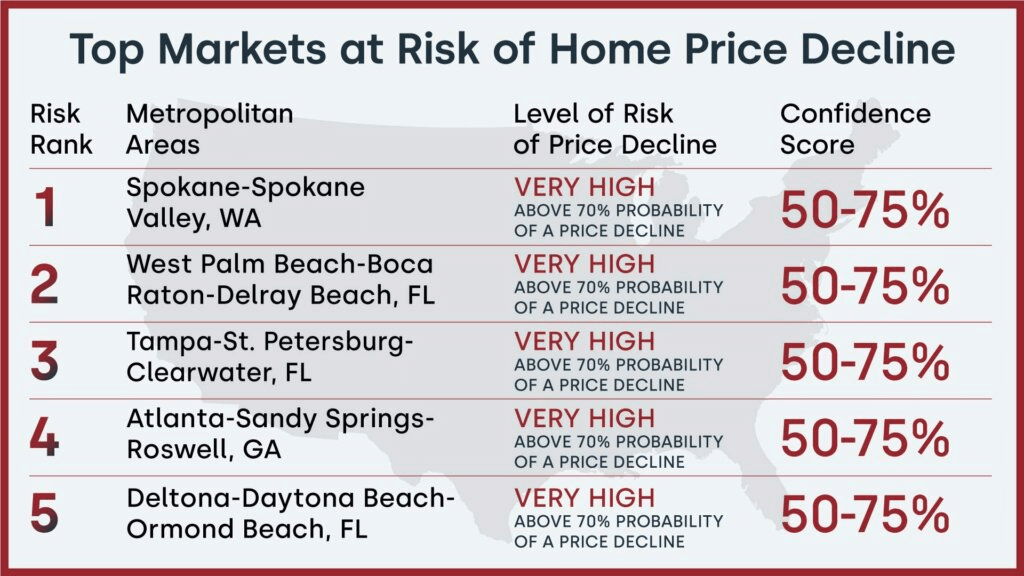

CoreLogic launched its residence value insights for February 2024, highlighting that all round housing expenses are continue to increasing. Property costs nationwide enhanced by 5.5% YoY in Dec 2023 but declined by -.1% Mom when compared to Nov 2023. In accordance to CoreLogic HPI Forecast, dwelling prices are expected to drop by -.2% Mother from Dec 2023 to Jan 2023 and maximize by 2.8% YoY from Dec 2023 to Dec 2024. The marketplaces with the greatest threat of rate declines are:

Resource: CoreLogic (February 2024)

Equally, Dana Anderson of Redfin notes that the median U.S. sale price rose 5.4% 12 months about 12 months during the 4 weeks ending February 4, the greatest enhance in about a calendar year. Superior housing fees are pricing out several would-be homebuyers pending revenue are down 8%, the largest drop in four months. There are also a several other contributors to product sales falling: Harsh wintertime weather conditions in the very first half of January delayed a ton of homebuying specials, and pending gross sales were being improving upon at this time last calendar year as house loan fees temporarily dropped.

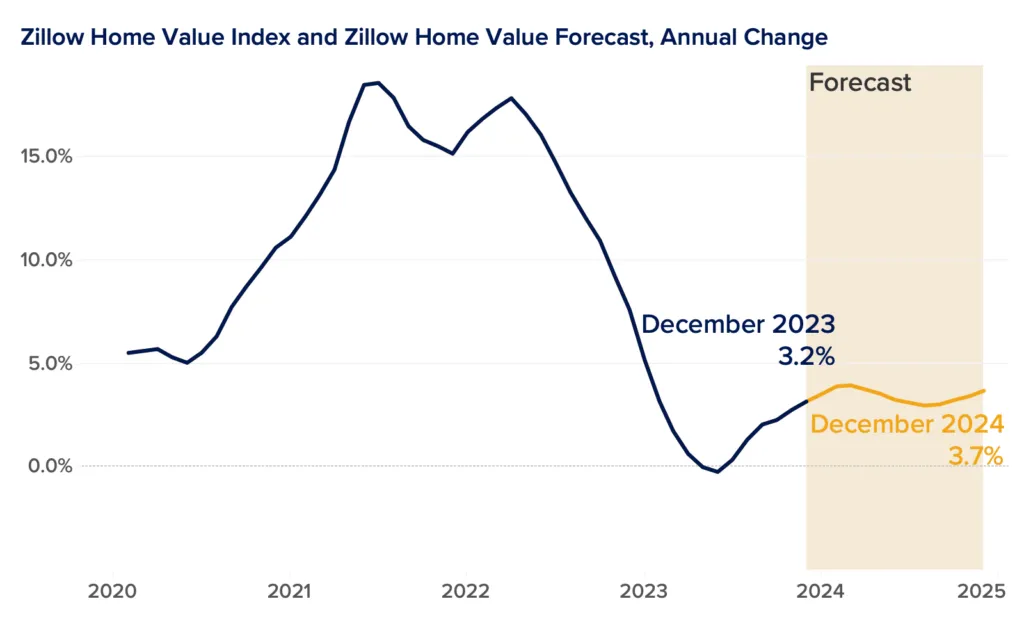

Zillow’s house price forecast for 2024 was revised upward this thirty day period, predicting a 3.7% increase in household values. External components, these as the decline in mortgage loan prices and an enhanced inflation outlook drove the revision. Zillow predicts 4.09 million present homes to sell in 2024, about the exact as in 2023.

Supply: Zillow (February 2024)

Jiayi Xu of Real estate agent.com experiences on pricing, noting that the median listing cost enhanced by .9% compared to the exact 7 days past 12 months. Household cost progress has eased from 2.2% to .2% in January but ticked up yet again during the very first week of February. House price ranges have been in a holding sample considering the fact that May well 2023, deviating from prior year stages only by a array of -.9% to +2.2%.

Rose Quint of NAHB reports on stubbornly superior housing price ranges, highlighting that concerning October and December 2023, only 37.7% of residences bought ended up inexpensive to families earning the median money of $96,300.

WeWork

Previous 7 days, it was extensively documented that the former CEO and founder of WeWork, Adam Neumann, sought to buy back the business. In accordance to TechCrunch: In a letter printed by The New York Instances now, legal professionals for Neumann, his hottest startup Movement Global Holdings LLC, and their affiliate marketers wrote that they have been dismayed with WeWorks deficiency of engagement even to give info in response to endeavours to be able to make an provide to obtain the corporation.

Alex Kirshner of Slate experiences on this enhancement, highlighting that Neumann has the backing of hedge fund proprietor Dan Loeb and that the bid has been in planning given that December but that the present-day WeWork leadership was stonewalling the proposed offer. As of final summer, WeWork noted it experienced $13 billion in extended-term lease obligations and virtually $3 billion in financial debt. As of the stop of June, WeWork said it had $13 billion in long-time period lease obligations, a determine it has been making an attempt to whittle down. It also shown $2.9 billion in very long-time period personal debt.

Rohan Goswami of CNBC reviews on the information, noting that WeWork advisors initially opposed Neumann’s proposals but later on advisable that he deliver DIP financing in its place of a time period sheet. It is uncertain from the letter whether or not WeWork and Neumann’s workforce had a non-disclosure agreement (NDA) in place, whilst the letter notes that the two functions experienced been exchanging markups on a single.

Pete Syme of Business enterprise Insider reports that WeWork submitted for bankruptcy in November and that the bid to invest in back WeWork is in partnership with Neumanns new undertaking, co-dwelling startup Movement, in which Andreessen Horowitz has by now invested. In reaction to the information, WeWork introduced a statement documented by Syme:

“WeWork is an incredible enterprise. As this sort of, we acquire expressions of interest from exterior functions on a normal basis. We and our advisors always evaluate these approaches with a perspective to performing in the ideal interests of the company. We proceed to believe that that the get the job done we are currently doing addressing our unsustainable lease charges and restructuring our business will make certain WeWork is finest positioned as an independent, precious, fiscally sturdy and sustainable business extensive into the future.”

DaleDaemicke.com Your Trusted Resource for Real Estate Insights

DaleDaemicke.com Your Trusted Resource for Real Estate Insights