According to Freddie Mac, the average 30-year mortgage rate fell slightly to 7.09% after a weak jobs report, but they are still hovering above seven percent. This impacts buyers and sellers, as potential sellers hesitate to list their homes at current rates. Elevated house prices make it challenging for potential buyers to afford a house in this high-rate environment.

Source: Freddie Mac (May 2024)

Rebecca Chen of Yahoo! Finance reports that this is the first time the weekly average rate fell in over a month. That said, financial institutions have modified their mortgage outlook for the rest of 2024 due to recent rate volatility. Fannie Mae increased its year-end prediction to 6.4% from 5.9%, while the National Association of Realtors (NAR) now expects rates to settle at 6.5% by year-end.

Diana Olick of CNBC reports that mortgage demand increased on the lowering rates. Refinance demand increased 5% last week but is still 6% lower than last year. Applications to buy homes rose 2% but are still 17% lower than a year ago. Home prices continue to rise, making it harder for potential buyers to afford homes. Tight supply is causing high competition and very few bargains.

The Mortgage Bankers Association (MBA) commented on the rise in applications, with Mike Fratantoni, MBA’s Senior Vice President and Chief Economist, noting that:

“Treasury rates and mortgage rates fell last week on the news of a slowing job market, with wage growth at the slowest pace since 2021, and the Federal Reserve’s announced plans to ease quantitative tightening in June and to maintain its view that another rate hike is unlikely. The conventional 30-year rate dropped 11 basis points, and the FHA rate fell 17 basis points to 6.92 percent, back below 7% for the first time in three weeks…Mortgage applications increased for the first time in three weeks, with refinances up 5 percent. Even with the increase, which included a 29 percent jump in VA refinances, refinance volume remains about 6 percent below last year’s already low levels.”

Aarthi Swaminathan of MarketWatch (subscription required) reports that consumers are expecting double-digit rates over the next three years, according to a New York Federal Reserve study. Specifically, consumers said they expect the 30-year mortgage rate to rise to 8.7% and 9.7% over the next three years.

Airbnb

Ashley Capoot of CNBC reports on Airbnb’s earnings, highlighting that its Q1 results beat analyst expectations. Revenues increased 18% to $2.14B, up from $1.82B in Q1 2023. Airbnb commented on the revenue growth, noting that it is experiencing a “robust demand for travel” ahead of the summer season.

Taylor Anderson of Inman comments on the earnings results, reporting that Airbnb’s Q1 profits were up 126% YoY, reaching $264 million, driven by the timing of Easter, which fell in late March this year. Revenue growth was higher than the total nights booked, and gross booking value increased by 9.5% and 12%, respectively. CEO Brian Chesky attributed the success to the company’s focus on lowering prices and increasing value for travelers.

Despite this, Max Juang of Yahoo! Finance reports that Airbnb shares dropped 9.5% following the results announcement. Airbnb reportedly gave future revenue guidance for Q2 that fell below analysts’ expectations and saw slower revenue growth overall. Overall, Juang reports, “This was a mixed quarter for Airbnb.”

Airbnb is seeking further international expansion, according to Rashaad Jorden of Skift. “CEO Brian Chesky said during its first-quarter earnings call that Airbnb is ready to step on the gas regarding international expansion. He cited Mexico, Brazil, China and Japan, among other countries, as markets on which the company is focusing. Chesky said Airbnb recently updated its app in China, and the company is making similar improvements in Japan and South Korea.”

Lisa Respers France of CNN reports that Airbnb is also stepping up experiences with the addition of ‘Icons,’ a collection of experiences hosted by big brands in music, film, television, art, and sports. So far, Disney, Doja Cat, Kevin Hart, and others are participating in the project. According to Chesky, “Icons take you inside worlds that only existed in your imagination – until now…As life becomes increasingly digital, we’re focused on bringing more magic into the real world. With Icons, we’ve created the most extraordinary experiences on Earth.”

Multifamily update

Erik Lynch of the National Association of Home Builders (NAHB) reports on the Multifamily Market Survey (MMS), which showed decreased confidence in newly built units. Multifamily developers are reported to be worried about higher interest rates, tight lending conditions, and project approval difficulties. Though existing apartments report strong occupancy, it may soften soon due to multiple units under construction. NAHB projects a 28% decline in multifamily starts this year as developer activity slows.

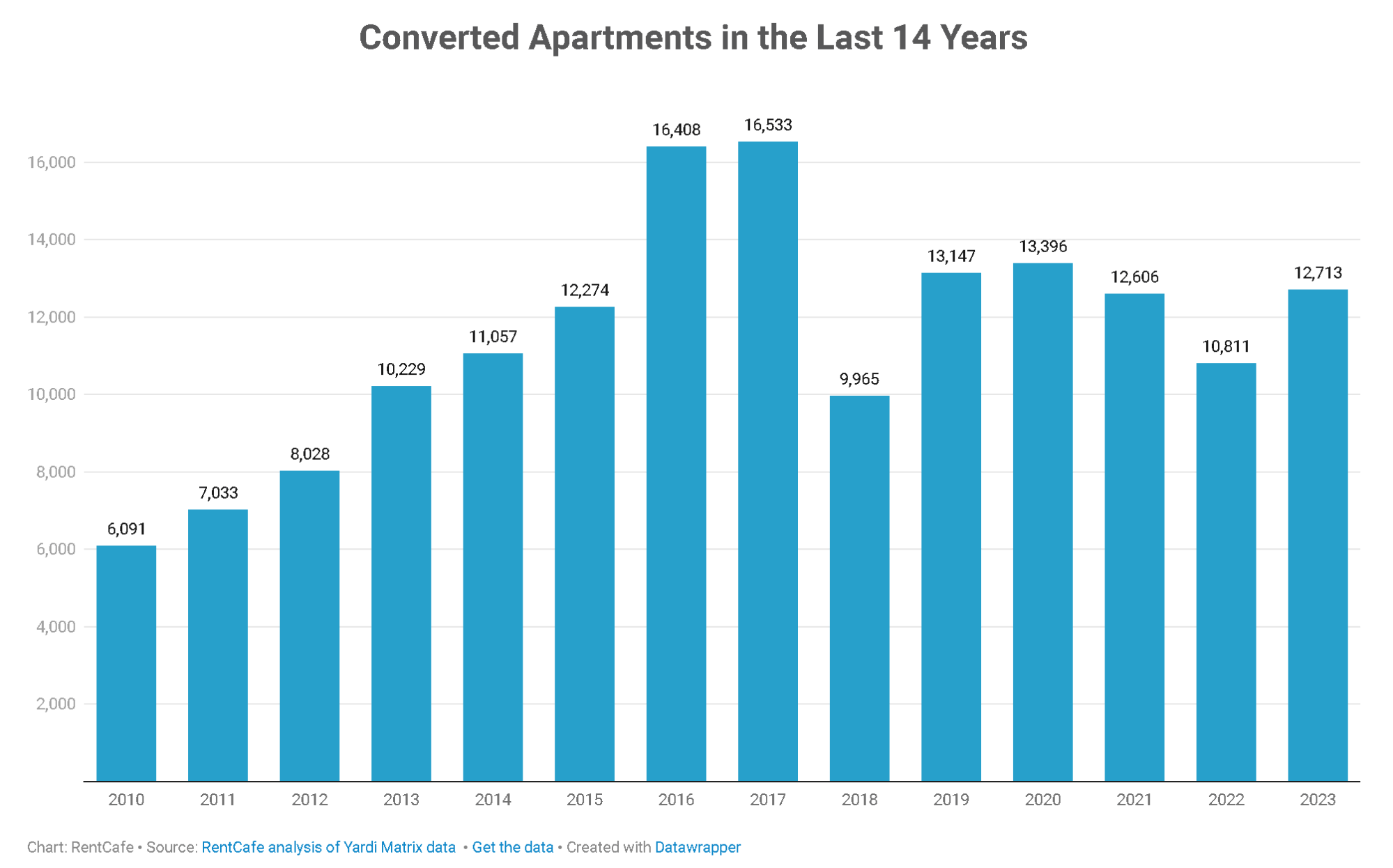

Although confidence in new multifamily is dropping, RentCafe recently released a report highlighting the increasing interest in adaptive reuse. Adaptive reuse projects—converting any older building into an apartment—rose 17.6% annually in 2023. Although old office buildings remain a popular adaptive reuse option, hotels also saw more conversions.

Source: RentCafe (May 2024)

“It’s not news that the hotel sector has faced many challenges and undergone transformations in recent years — particularly due to the pandemic, which caused a flight to quality in the tourism sector. Unsurprisingly, outdated hotels bore the brunt of reduced traveling and steep debt service costs, prompting many owners to offload their underperforming properties. Naturally, this created an opportunity for developers to swiftly repurpose these properties into apartment buildings, especially in places boasting a large number of hotel properties, such as New York City.”

Skylar Olsen of Zillow reports on rents, highlighting that they continued to trend upward in April. Specifically, the typical U.S. rent is now at $1,997, with rents growing 0.6% monthly. To afford a rental at that price, renters would need to make nearly $80,000 a year. This is an increase from five years ago when renters needed to make less than $60,000 to afford the typical U.S. rental comfortably.

Things aren’t expected to slow down, according to Paul Bubny of ConnectCRE. “U.S. multifamily rent growth is expected to accelerate in the second half of 2024 as new construction completions decelerate and positive net absorption continues.”

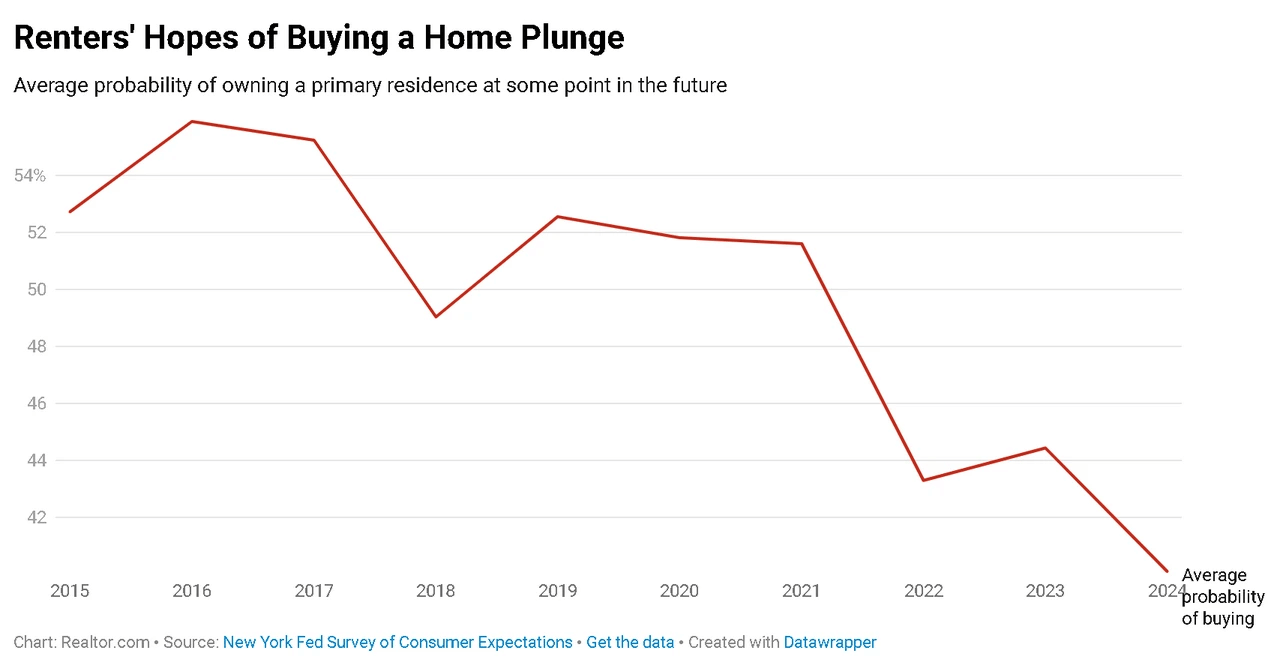

This is why renters are pessimistic about their homebuying potential, according to Keith Griffith of Realtor.com. A recent survey showed that renters’ probability of owning a home in the future has dropped to a record low of 40.1% from 44.4% last year. The Northeast region was hit the hardest, with renters’ probability of owning a home dropping to 25.8% from 51.4% last year. The Midwest also saw a decrease of 6 percentage points, while the South remained flat, and the West saw an increase of 2.5 percentage points.

Source: Realtor.com (May 2024)

The post Rates drop, but don’t expect much more in 2024 appeared first on Stessa.

DaleDaemicke.com Your Trusted Resource for Real Estate Insights

DaleDaemicke.com Your Trusted Resource for Real Estate Insights