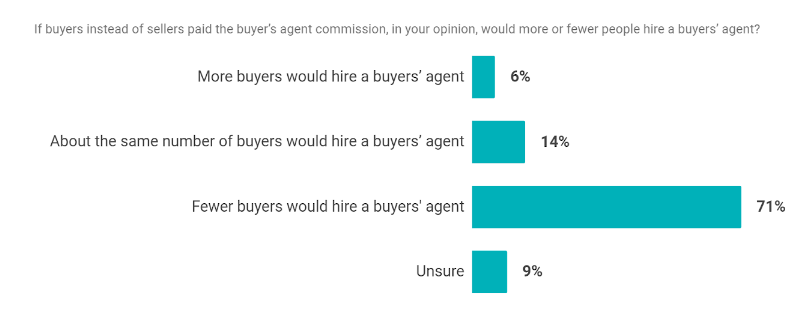

The National Affiliation of Realtors (NAR) has settled the commissions lawsuit, in accordance to David Goldman and Anna Bahney of CNN. NAR settled landmark antitrust lawsuits by spending $418 million in damages and eliminating some of its regulations on commissions. The NAR also agreed to apply a established of new guidelines, which include prohibiting agents’ payment from getting involved on listings positioned on local centralized listing portals. One more new rule necessitates buyers’ brokers to enter into written agreements with their purchasers.

Alex Veiga of Reuters reports on the story, highlighting that the new rule modifications established to impact in mid-July could guide to homebuyers and sellers negotiating lower authentic estate agent commissions. This practice has been customary due to the fact the 1990s, as brokers doing work with a buyer and seller ordinarily split a fee of around 5% to 6% paid out by the seller. Nevertheless, the rule modifications agreed by the NAR as section of a settlement could give home sellers and consumers more impetus to negotiate decreased agent commissions.

Source: Redfin (March 2024)

This will have considerable implications for homebuyers and true estate buyers alike, according to Debra Kamin of the New York Situations: The deal, and the envisioned discounts for house owners, could result in one particular of the most important jolts in the U.S. housing industry in 100 years…Americans pay back roughly $100 billion in authentic estate commissions every year, and real estate agents in the United States have some of the best normal commissions in the environment.

Steven Byerley of MPA studies on the alterations, noting that by enabling purchasers to negotiate payment upfront, the settlement could usher in a new period of price consciousness between buyers. Some may possibly decide on to forego regular agent products and services entirely, when others may perhaps decide for confined products and services at diminished costs. For instance, consumers may opt to fork out brokers solely for aid with give preparing and inspection assessment, foregoing the require for agent-led household tours.

SFRs

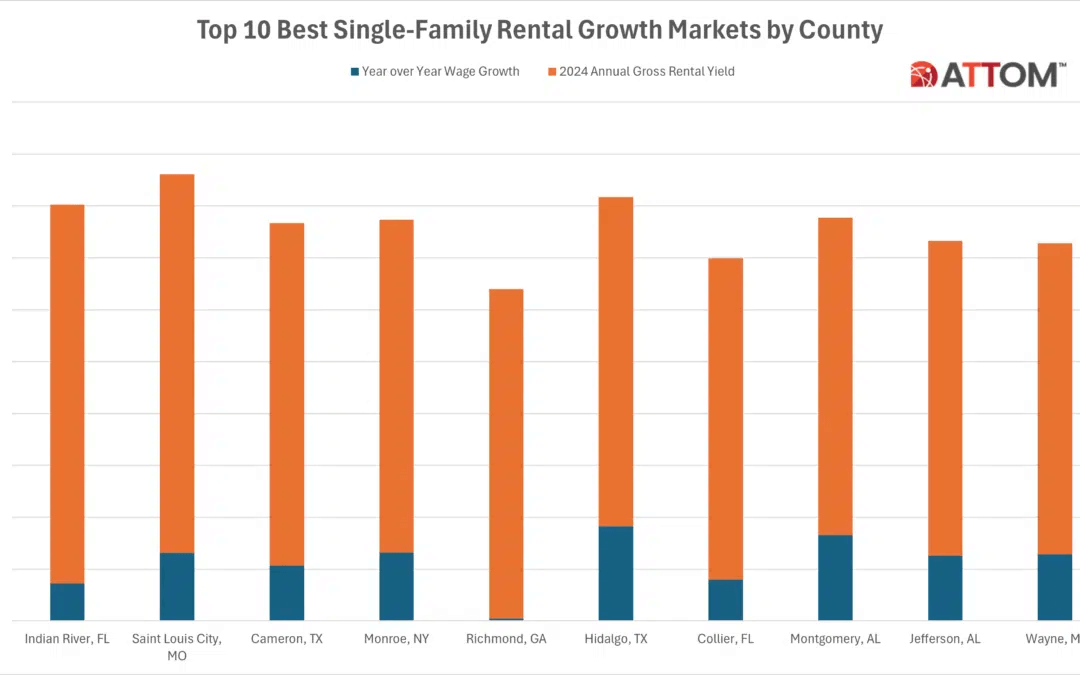

ATTOM Facts Methods produced a new report showing the prime counties for acquiring and selling one-family members rentals. Soaring rents outcome in greater investment returns for landlords, as rental demand from customers is driven by a constrained provide of properties for sale and a slowdown in dwelling cost boosts.

Resource: ATTOM (March 2024)

The Q1 solitary-family rental report famous that rental returns are on the rise throughout most of the country. Probable yearly gross rental yields for 3-bedroom attributes in 2024 have improved when compared to 2023 in 216 out of the 341 counties analyzed in the report (63 p.c). Primary the boost are counties these as Taylor County (Abilene), TX (produce up from 7.6 percent in 2023 to 11.3 % in 2024) Jefferson County (Birmingham), AL (up from 8.5 percent to 12.1 per cent) Richmond County (Augusta), GA (up from 9.6 percent to 12.7 p.c) Midland County, TX (up from 8.7 percent to 11.7 %) and Aiken County, SC (outside Augusta, GA) (up from 8.4 percent to 11.1 p.c).

Connie Kim of HousingWire experiences on ATTOMs info, highlighting that the ordinary yearly gross rental yield for a a few-bed room residence in the similar markets is projected to boost from 7.39% in 2023 to 7.55% in 2024.

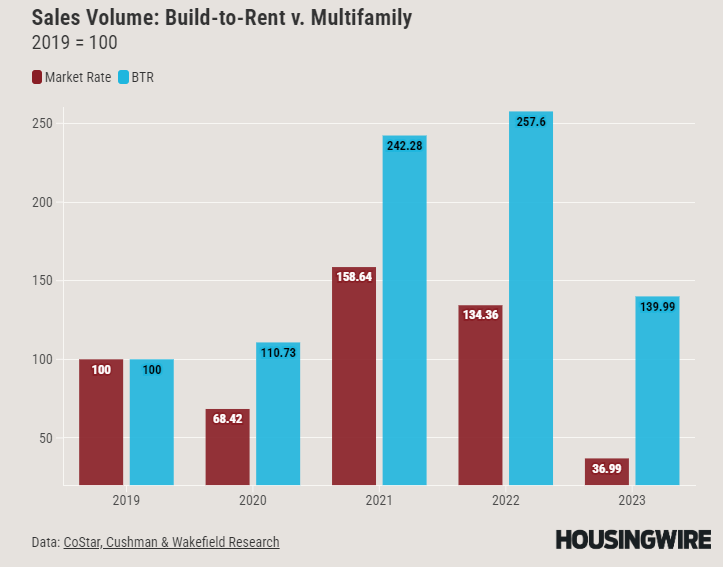

Will Robinson, also of HousingWire, reports on the establish-to-hire sector, noting that financial investment firms Pretium Companions and Blackstone spend billions to receive make-to-rent properties. The place faces a intense housing shortage because of to many years of underbuilding and underinvestment. Robinson notes that Cushman & Wakefield predict that institutionalization is imminent for the sector as need for rentals remains large thanks to tight for-sale inventories and superior property prices.

Source: HousingWire (March 2024)

Richard Berger of Globe St stories on the rise in SFRs, highlighting a new report by Northmarq demonstrating that renting a single-household house is $825 more affordable than getting a person with a typical home finance loan payment. Emptiness fees for solitary-relatives rentals remained elevated in the course of 2023, peaking at 8% in the course of Q1 and ending the calendar year at 7.8%, which is 300 basis factors larger than the 2021 small.

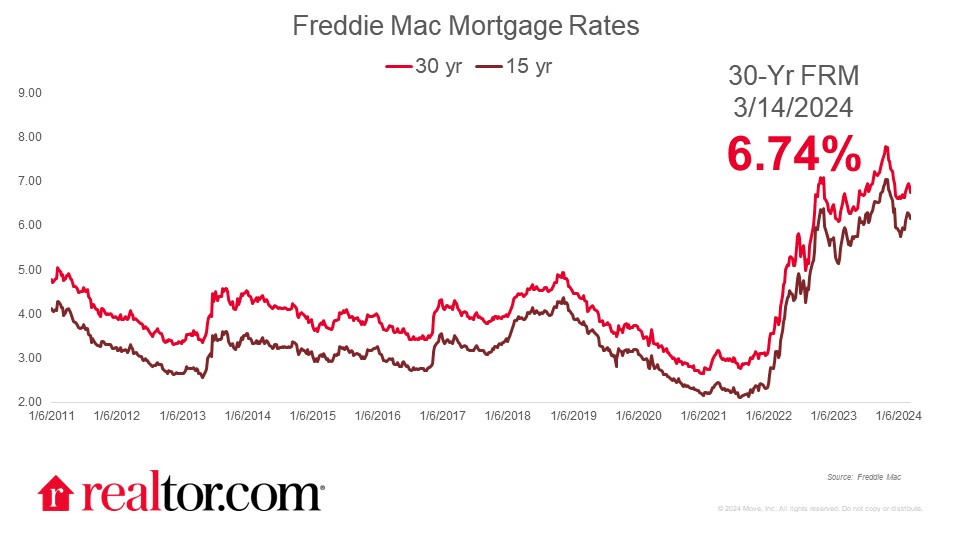

Premiums tumble, listings surge

Hannah Jones of Real estate agent.com stories on slipping home finance loan prices, noting that the 30-12 months property finance loan level fell 14 foundation factors to 6.74% because of to sturdy work and inflation information. Home loan prices continue to be elevated owing to inflation knowledge that is not strengthening at the needed rate.

Resource: Realtor.com (March 2024)

Todays homebuyers are somewhat optimistic about the path of property finance loan rates. As the spring heats up, some purchasers may well maintain off in the hopes that home finance loan premiums move reduced, but possibly alternative (obtaining now or ready) comes with tradeoffs. Spring potential buyers may well see greater mortgage loan costs, but summertime purchasers are probably to see better home price ranges and uncertainty all around mortgage rates.

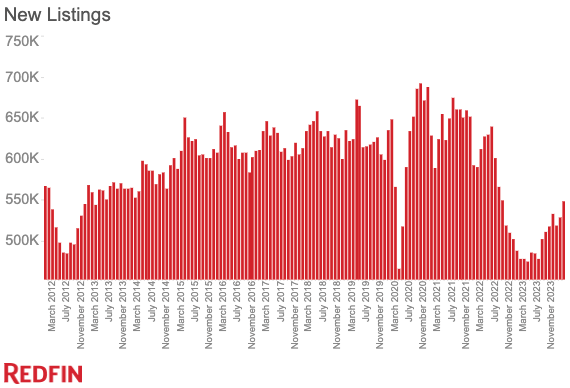

Information from Redfin highlights that listings have increased as we enter the busier spring homebuying time. Pending dwelling revenue lessened by 6% YoY because of to high housing expenses, but mortgage-buy applications rose for the 2nd week in a row. The provide of residences is enhancing, with new listings up 13% and the total variety of residences for sale up 3%.

Source: Redfin (March 2024)

Redfin Economic Analysis Direct Chen Zhao opinions:

House loan premiums are possible to stay higher a minor extended than predicted, with the hottest inflation report fundamentally getting rid of any opportunity of the Fed reducing fascination premiums ahead of JuneBuyers who can afford to could want to get serious about their residence research now, as housing charges are not likely to fall anytime shortly. The uptick in listings really should be yet another motivator for prospective buyers: Theres more to pick out from, and strengthening inventory may well provide out much more level of competition from other buyers as we get further more into spring. Some potential buyers have presently gotten the memo, with mortgage loan purposes finally increasing soon after weeks of declines.

Mike Simonsen of HousingWire reviews on vital dwelling listing info, exhibiting that stock could go significantly bigger more than the coming calendar year.

- There are now just about 500,000 solitary-relatives homes on the current market in the U.S.

- Thats up a half p.c from final week and is now 21% a lot more than a calendar year ago.

- There are 100,000 additional one-family residences on the industry than there were being in March of final year.

- Except house loan rates fall from here, then by July, we could have 40% much more houses on the marketplace than a 12 months in the past.

DaleDaemicke.com Your Trusted Resource for Real Estate Insights

DaleDaemicke.com Your Trusted Resource for Real Estate Insights